Everbright Securities International offers fantastic margin financing at a highly competitive interest rate. Easy and convenient, there are many advantages in IPO financing.

What is an IPO?

According to the Listing Rules, equity securities may be listed through a number of methods, including public subscription, offer for sale, placing and introduction. An IPO is the first-time sale of equity shares of a company through public subscription. An IPO must be accompanied by a prospectus which provides detailed corporate, financial and other relevant information of the company approved for listing and the timetable for the IPO. Investors can obtain prospectuses and application forms from broker firms or designated banks as set out in the section of a prospectus usually headed How to Apply for the Public Offer Shares.

How can I subscribe online?

You simply need to open a securities trading account with Everbright Securities Digital Finance (HK) Limited ("EBSDFHK") to subscribe for the IPO shares. Customers simply login EBSI Direct webpage and follow the relevant procedures to complete the subscription for the shares. The allotted shares will be directly credited to your EBSDFHK securities trading account on the allotment day, you can trade your shares on or after the first listing day.

IPO Margin Financing Services

We are one of the leaders in Hong Kong for providing IPO financing. We offer financing to our customers at a competitive interest rate. We can lend up to 90% of the value of shares you subscribed for, thus leveraging your buying power. Please contact our customer service for more details.

IPO financing is a powerful tool with numerous advantages.

Investments involve risk. Please click here for the Risk Disclosure Statements.

You can subscribe IPO in three easy steps.

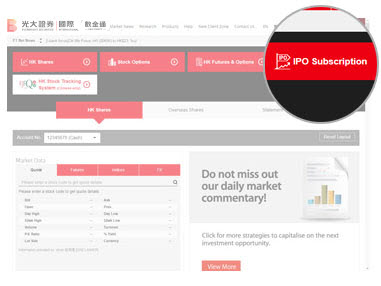

Login to your account

Click the "IPO Subscription" button in Trading page.

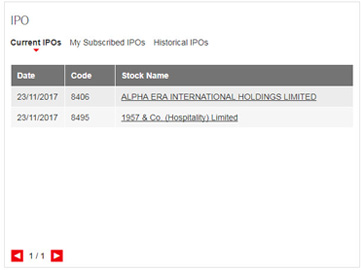

Click on the stock name that you want to subscribe and then submit the application form